The tariff landscape changed dramatically in 2025, and it’s not likely to settle anytime soon. Wind turbine manufacturers are responding with a strategy that was rarely considered in the past: retaining and remanufacturing legacy components rather than importing new ones.

At North Coast Enterprise, we’re seeing this shift in real time across our project portfolio. OEMs that previously defaulted to replacing everything during repowering are now asking a different question: Which legacy components can we retain, refurbish, and recertify?

The Tariff Reality

Imported wind turbine components face significantly higher tariffs than they did a year ago. For manufacturers managing hundreds of repowering projects, these costs add up quickly. A gearbox that crossed the border at one price in 2023 now carries a substantially different cost structure.

The math is forcing new conversations. When you’re planning a 50-turbine repower, even modest per-unit tariff increases translate to millions in additional project costs. That changes the economics of what gets replaced versus what gets retained.

What Component Retention Actually Means

Component retention may sound like a short cut, but it’s better thought of a strategic remanufacturing.

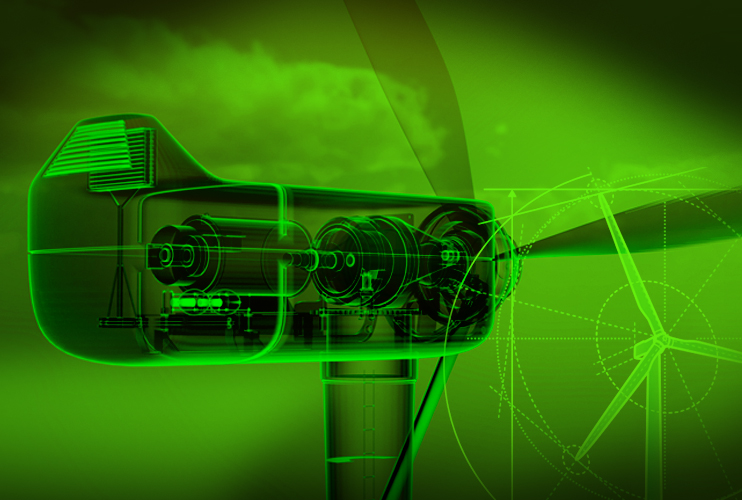

Let’s break it down. During a repowering project, certain legacy components—gearboxes, generators, power electronics, even some structural elements—are removed, inspected, refurbished to OEM specifications, recertified, and reinstalled in upgraded turbines.

The critical word is “recertified.”

We’re not talking about patching together old equipment and hoping it works.

Manufacturers are applying the same quality standards to remanufactured components that they apply to new ones. The difference is where the component originates: a legacy turbine on-site rather than a factory overseas.

Why This Works for Repowering

Repowering projects already involve substantial component exchange. You’re replacing blades, upgrading nacelle internals, installing new control systems. The question becomes: Which components genuinely need replacement for performance reasons, and which are being replaced simply because that’s how we’ve always done it?

The tariff environment is forcing more rigorous answers to that question. And in many cases, the answer is surprising: A well-maintained gearbox or generator from a 10-12 year old turbine, properly refurbished and recertified, can deliver performance comparable to a new import—at a fraction of the cost.

This isn’t about extending the life of failing equipment. It’s about recognizing that not every component reaches end-of-life on the same timeline. Some elements wear out. Others have substantial useful life remaining. Smart repowering means distinguishing between the two.

The Logistics Challenge

Component retention creates new operational complexities. Instead of disposing of all legacy equipment, we’re now segregating components based on retention potential.

That requires:

- Early coordination between owners, OEMs, and decommissioning partners

- Detailed component assessment before removal begins

- Specialized handling and storage for retained components

- Clear chain of custody from removal through recertification

- Integration with existing project schedules and budgets

At North Coast, this means our role is evolving. We’re not just managing disposal; we’re managing a more sophisticated material flow where some components exit the project stream entirely, while others loop back into the repowering process.

What This Means for Project Planning

If you’re planning a repowering project for 2025 or 2026, component retention should be part of your conversation from day one, not something considered during execution.

The key questions to address:

With your OEM: Which components are candidates for retention and remanufacturing? What’s the assessment and recertification process? What warranties or performance guarantees apply?

With your project team: How does component retention affect project timeline and sequencing? What’s the cost-benefit analysis including tariff savings?

With your decommissioning partner: What handling, storage, and logistics infrastructure is needed? How do we maintain component integrity through the retention process?

The answers vary by project, by OEM, by component type. But the underlying principle is consistent: In the current tariff environment, assume nothing about disposal until you’ve evaluated retention options.

The Strategic Shift

Component retention and remanufacturing represent a strategic shift in how the industry thinks about repowering. This may not be a temporary fix, but rather a new way of engaging broad swaths of the wind sector.

For years, the default assumption was that repowering meant wholesale replacement—take everything out, put everything new in. That approach made sense when import costs were predictable and supply chains were stable.

Neither of those conditions exists today. Tariffs have changed the economics. Supply chain disruptions have highlighted the risk of depending entirely on imports. And the industry has matured to the point where we have a substantial installed base of relatively young equipment that hasn’t reached actual end-of-life.

Component retention isn’t about making do with less. It’s about being smarter with what you already have.

North Coast’s Role

Our expertise in wind turbine decommissioning puts us at the center of these conversations. We understand component condition assessment, we manage the logistics of component handling, and we coordinate with manufacturers on retention programs.

But more importantly, we understand that our job is not mere disposal but actually helping clients optimize the entire material lifecycle of their repowering projects. Sometimes that means comprehensive recycling. Sometimes it means component retention. Often it means both, executed strategically based on project-specific economics and technical requirements.

We’ve completed more than 60 major wind decommissioning projects since 2022. Component retention is adding complexity to that work, but it’s also creating value for our clients in ways that weren’t available a year ago.

Looking Ahead

The tariff environment may shift again. Policy changes. Trade agreements evolve. But the underlying principle—evaluating what genuinely needs replacement versus what can be retained and remanufactured—will persist regardless of tariff levels.

Component retention is making the industry think more carefully about material flows, component lifecycles, and the true definition of “end-of-life.” That’s a good thing, regardless of what drives it.

For owners planning repowering projects, the message is clear: Don’t assume disposal is the only option for legacy components. In today’s tariff environment, retention and remanufacturing may deliver better economics while maintaining performance and reliability.